Keith's Past Life (Corporate) Resume

Accomplishments:

Consulted on more than 25 successfully completed mergers and acquisitions in the financial services industry.

Conceptualized and developed the financial model for top Investment Company to outsource support to India.

Streamlined links between Investment Company’s time management and accrual accounting systems.

Standardized and streamlined Insurance Brokerage’s due diligence process for reviewing prospective acquisition targets.

Re-engineered investment bank’s business valuation model, created a template for writing offering memorandums and integrated the two models to accommodate real-time changes.

Led accredited workshops on financial statement analysis for Insurance Education Association.

Developed automated (and copywrited) financial analysis model of insurance companies.

Employers:

Franklin Templeton (San Mateo, CA)

Management Consultant (2000-01)

Supported Senior IT Directors with strategic planning, spreadsheet based budgeting, financial modeling and internal business analysis.

Corporate Finance Advisors (San Francisco, CA)

Vice President & Principal (1996-98)

Merger & Acquisition Consultant representing primarily buyers.

Russell Miller Corporate Finance (San Francisco, CA)

Associate (1993-95), Senior Associate (1995-96)

Merger & Acquisition Consultant representing primarily sellers.

Talegen / Crum & Forster (Basking Ridge, NJ)

Financial Analyst (1990-91), Senior Financial Analyst (1991-93)

Marsh & McLennan / Seabury & Smith (New York, NY)

Market Standards Analyst (1987-90)

Education and Training:

MBA – Finance & International Business

New York University’s Stern School of Business (1992)

BA – Business & Economics

University of California, Santa Barbara (1985)

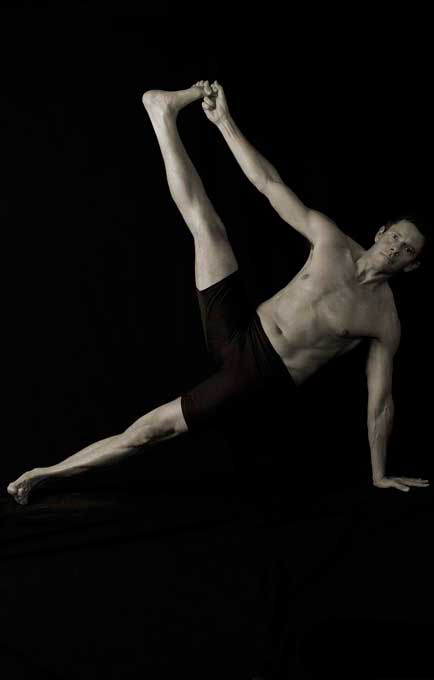

What limits people is that they don’t have the nerve or imagination to star in their own movie, let alone direct it.